do you have to pay taxes on inheritance money in wisconsin

Wisconsin does not have a state inheritance or estate tax. If death occurred prior to January 1 1992 contact the Department of.

Connect With An Expert For Unlimited Advice.

. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. At the time you receive the benefits youll have to pay any taxes that are payable. Who has to pay.

Dont Know How To Start Filing Your Taxes. Iowa does not have an estate tax. Upon your death you can transfer a certain amount of assets without paying any estate tax.

SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. There is no Wisconsin Estate Tax. Do you have to pay taxes on inheritance in Iowa.

Ad Search For Info About Do you have to pay taxes on inheritance money. Kentucky for example taxes. The inherited annuitys remaining funds can be withdrawn in a single payment if desired.

As of 2021 the six states that charge an inheritance tax are. However if you are inheriting property from another. Do you have to pay taxes on inherited money in Wisconsin.

The inheritance tax is based on the value of property that a beneficiary receives from a. Connect With An Expert For Unlimited Advice. Browse Get Results Instantly.

The Federal estate tax only affects02 of Estates. Ad Inheritance and Estate Planning Guidance With Simple Pricing. In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax.

The first rule is simple. This amount is called the estate tax exemption. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

If you are a beneficiary you generally do not have to include inheritance on your income tax return. Thats because federal law doesnt charge any inheritance taxes on the heir directly. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

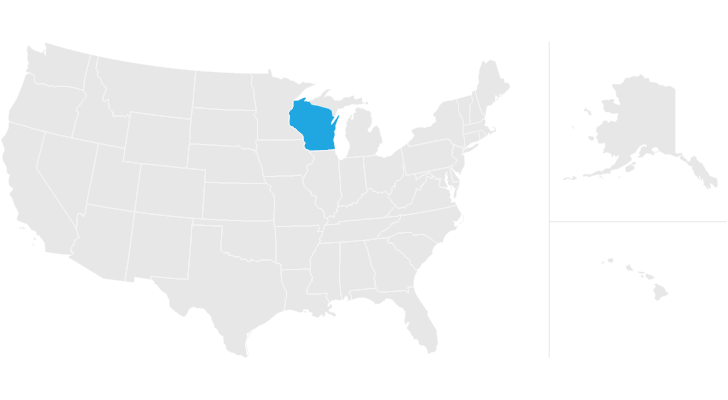

Wisconsin does not levy an inheritance tax or an estate tax. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Inheritance tax rates differ by the state.

Wisconsin also has no inheritance tax but there is a possibility youll owe an inheritance tax in another state if you inherit money or property from someone living in that. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent. Dont Know How To Start Filing Your Taxes.

However if you are inheriting property from another state that state may have an estate tax that applies. That said you could be strategic about when you sell says. In 2017 the federal government set.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Wisconsin Inheritance Tax Return. It is possible to pay.

These states have an inheritance tax. Wisconsin does not levy an inheritance tax or an estate tax. Inheritances that fall below these exemption amounts arent subject to the tax.

When it comes to paying capital gains taxes on inherited money theres not much you can do to minimize the tab. There is no wisconsin inheritance tax for decedents dying on or after january 1 1992. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is.

If you receive property in an inheritance you wont owe any federal tax.

Irs Announces Higher 2019 Estate And Gift Tax Limits

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Wisconsin Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2021 Taxes And New Tax Laws H R Block

Wisconsin Estate Tax Everything You Need To Know Smartasset

The Importance Of An Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Estate Planning

Wisconsin Estate Tax Everything You Need To Know Smartasset

Selling A Home Held In A Trust Is All About Timing

Gift Tax How Much Is It And Who Pays It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Your Inheritance Considered Taxable Income H R Block

States With An Inheritance Tax Recently Updated For 2020

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Do I Pay Taxes On Inheritance Of Savings Account

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pin By Megan Cook Dixon On Real Estate Probate Attorneys Estate Planning